Services

Certified QuickBooks ProAdvising

From sales and installation, to customizing and training. On-site and telephone support.

Public Accounting

Don't want to do your own books, but don't want to hire another employee? Let me take care of it for you.

Payroll Services

Just needing a little help getting those paychecks out? Quarterly filings and deposits a hassle? Problem solved.

Bookkeeping Tips - the following article comes from NBA, National Bookkeepers Association.

Customizing QuickReports and Preset Reports

Each QuickReport window has a buttonbar at the top of the report for customizing report content and layout.

In this exercise, you'll customize the QuickReport you just created to display transaction numbers in the report.

To add a column to a report:1 In the QuickReport window, click Modify Report.

QuickBooks displays the Modify Report window.

Use the Display tab of the Modify Report window to select the columns to include in the report and the date range of the report.

2 In the Columns list, select Trans #.

QuickBooks displays a checkmark next to Trans # to indicate that it's selected.

3 Click OK to accept the change.

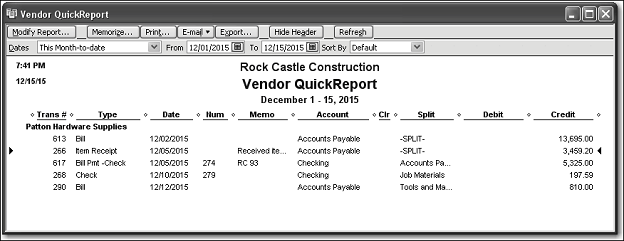

QuickBooks displays the customized vendor QuickReport.

Notice that the item receipt from Patton Hardware Supplies is now listed as Transaction #266.

Next, you'll move the Trans # column to a new position in the report.

To move a report column:

1 Position your mouse pointer over the Trans # column that you added to the QuickReport.

The mouse pointer changes shape to look like a hand.

2 Hold down the left mouse button and drag the Trans # column to the right until you see an arrow between the Date Column and the Num column.

3 Release the mouse button.

QuickBooks places the Trans # column between the Date column and the Num column.

Next, you'll use the QuickReport buttonbar to customize the report header.

To change information in the report heading:

1 In the QuickReport window, click Modify Report, then click the Header/Footer tab.

On the Header/Footer tab, you can change the company name, report title, subtitle, and date and time prepared. You can also specify whether to print the header on all pages or on just the first page. The Header/Footer tab is the same for all QuickBooks reports.

Use this window to change the report title from Vendor QuickReport to Vendor History Report.

2 In the Report Title field, highlight the text for "Vendor QuickReport," and type Vendor History Report to replace the title.

3 Click OK to close the Modify Report window.

QuickBooks changes the title of the report and displays the new report.

4 Close the QuickReport window.

5 Close the Vendor Center.

Creating and Customizing Preset Reports

In addition to QuickReports, QuickBooks has dozens of preset report formats. You can create profit and loss reports, balance sheet reports, accounts receivable reports, sales reports, accounts payable reports, inventory reports, and many other types of reports.

The Report Center categorizes the preset reports into 12 major categories:

Company & Financial reports include the following:

•Profit and loss reports give you a global view of your company's income, expenses, and net profit or loss over a specific period of time.

•Balance sheet reports show the financial position of your business by listing assets, liabilities, and equity.

•Statement of cash flows reports show the net change in your cash during a period of time.

Customers & Receivables (accounts receivable) reports give you information about the receivables side of your business: which invoices are due (or overdue), how much each customer owes your company, and so on.

Sales reports give you information about what you have sold and to whom.

Jobs, Time & Mileage reports give information about the profitability of jobs, how well your company is doing at estimating jobs, how much time is spent on each job, and the mileage expenses for each vehicle or job.

Vendors & Payables (accounts payable) reports give you information about the payables side of your business, including which bills are due, information about vendors and transactions that require 1099s, your sales tax liability, and your current balance with each vendor.

Purchases reports give you information about your purchases and open purchase orders.

Inventory reports give you information about status (such as the quantities you have on hand or on order) and the value of your inventory.

Employees & Payroll reports summarize the information you need to pay your current payroll liabilities and fill out your tax forms.

Banking reports include check detail, deposit detail, missing check reports, and reconciliation reports.

Accountant & Taxes reports summarize information that you need to give to your accountant and information to help you monitor activity in the company file. These include income tax summary, income tax detail, general ledger, trial balance, journal, transaction journal, and audit trail reports.

Budget & Forecast reports show how your income and expenses compare to the budgets you've set up and help you forecast income and expenses and compare actual values to forecasts.

List reports let you report on any information stored in a QuickBooks list.

Industry-specific reports are available in each of the industry-specific editions of QuickBooks. Accountant Edition includes the reports from all of the industry-specific editions.

Call today for your free, no obligation consultation.

970-596-4536